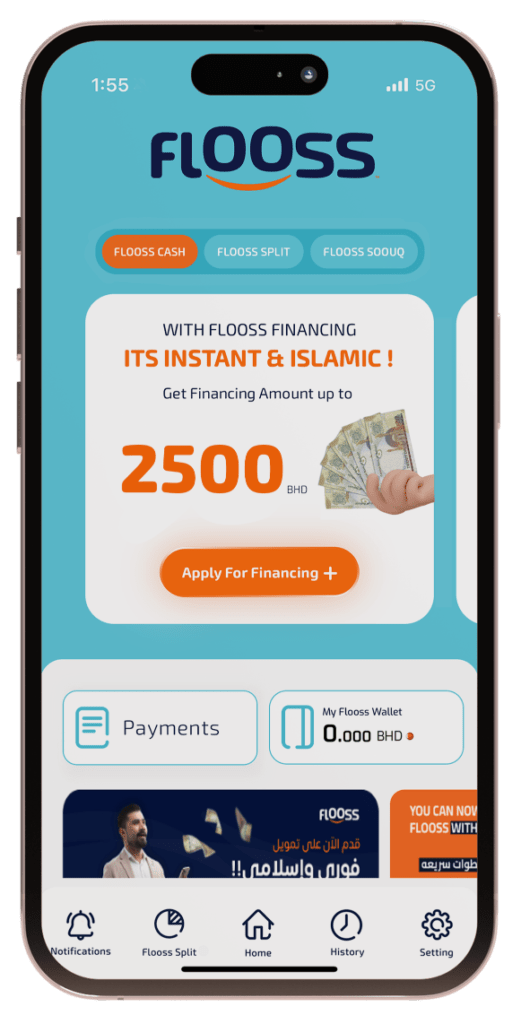

THE FASTEST WAY TO ON-DEMAND ISLAMIC FINANCING FOR NATIONALS & EXPATS IN BAHRAIN

Discover how much you can initially borrow with our user-friendly financing calculator to start planning with confidence

UP TO BHD 2,500 FOR EXTRA SPENDING

24/7 ACCESS & FIND SUPPORT

FINANCING SOLUTIONS

BY THE CBB AS A FINANCING COMPANY