FLOOSS, a leading fintech company, has been harnessing the power of Open Banking to successfully transform the loan approval process quickly.

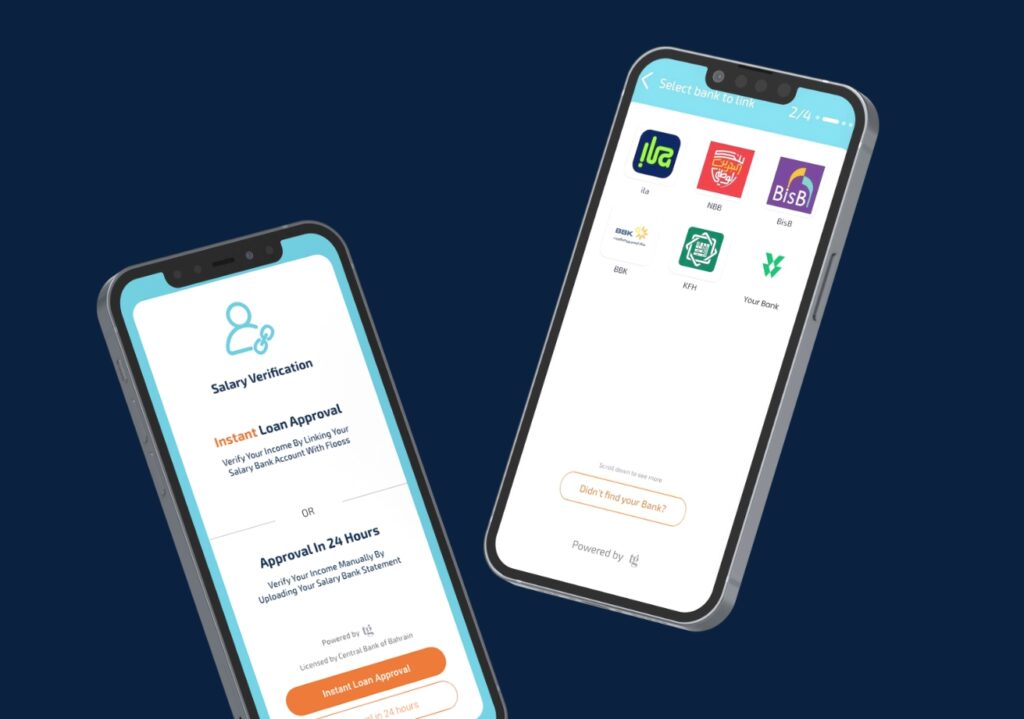

In a groundbreaking move, FLOOSS using Tarabut has seamlessly streamlined access for FLOOSS customers who are clients of Ila Bank, NBB, BBK, BISB, KFH, and Al Salam Bank by now taking advantage of the upgraded services provided by Open Banking. This strategic expansion showcases FLOOSS’s dedication to delivering an exceptional user experience to its customers.

This innovative collaboration has revolutionized the financial industry by enhancing efficiency and accessibility for individuals.

For FLOOSS, Open Banking is emerging as a game-changer in the financial industry, offering a multitude of benefits that streamline financial services processes, enable data-driven decision-making, and foster greater competition and innovation.

At its core, FLOOSS believe in putting customer experience first means finding solutions like this that simplify the once complex processes. This technology-driven approach has the potential to reshape the way we approach banking and lending forever, upgrading the customer experience and opening up new opportunities for financial inclusion

Key Benefits of the Partnership:

Lightning-Fast Loan Approvals: By leveraging Open Banking technology, FLOOSS processes open banking loan applications and provides approvals within six minutes. This unparalleled speed eliminates the lengthy waiting periods traditionally associated with loan processing to access funds quickly and efficiently.

This disruptive move sets a new standard for efficiency and accessibility in loan approvals, challenging the status quo and inspiring other financial institutions to embrace innovative solutions.

Looking ahead, FLOOSS plans to continue spearheading advancements in customer first lending, watch this space for an exciting year of announcements .